Personal Loans Canada Things To Know Before You Get This

Personal Loans Canada Things To Know Before You Get This

Blog Article

The Best Guide To Personal Loans Canada

Table of ContentsExcitement About Personal Loans CanadaAll About Personal Loans CanadaSome Known Details About Personal Loans Canada The Ultimate Guide To Personal Loans CanadaOur Personal Loans Canada Statements

Payment terms at many personal lending lenders range in between one and 7 years. You receive all of the funds simultaneously and can use them for virtually any kind of objective. Borrowers usually use them to finance a property, such as a lorry or a watercraft, repay financial debt or help cover the expense of a major cost, like a wedding or a home renovation.

A set price provides you the security of a predictable regular monthly repayment, making it a popular choice for combining variable price credit scores cards. Settlement timelines differ for personal financings, but customers are frequently able to select settlement terms between one and 7 years.

The Buzz on Personal Loans Canada

The fee is generally subtracted from your funds when you finalize your application, lowering the amount of cash you pocket. Personal loans rates are much more directly connected to short term rates like the prime price.

You may be offered a lower APR for a shorter term, because loan providers recognize your equilibrium will be settled much faster. They might bill a greater price for longer terms knowing the longer you have a loan, the more probable something could change in your funds that can make the payment expensive.

A personal lending is likewise a good alternative to utilizing bank card, given that you borrow cash at a set price with a precise payback day based upon the term you choose. Remember: When the honeymoon is over, the regular monthly settlements will be a pointer of the money you spent.

Personal Loans Canada - Truths

Before taking on financial debt, utilize a personal lending payment calculator to aid budget. Gathering quotes from several lenders can assist you spot the best deal and potentially conserve you passion. Contrast rate of interest, fees and lending institution online reputation before making an application for the loan. Your credit history is a large consider identifying your qualification for the finance in addition to the interest price.

Before using, recognize what your rating is to make sure that you recognize what to anticipate in terms of expenses. Be on the search for hidden fees and penalties by reviewing the loan provider's terms page so you do not wind up with less cash than you require for your monetary goals.

Personal car loans need evidence you have the credit profile and revenue to settle them. Although they're easier to receive than home equity loans or other secured loans, you still require to show the lending institution you have the ways to pay the financing back. Individual fundings find this are much better than bank card if you desire a set regular monthly payment and require all of your funds simultaneously.

What Does Personal Loans Canada Mean?

Credit cards may additionally supply rewards or cash-back choices that individual loans do not.

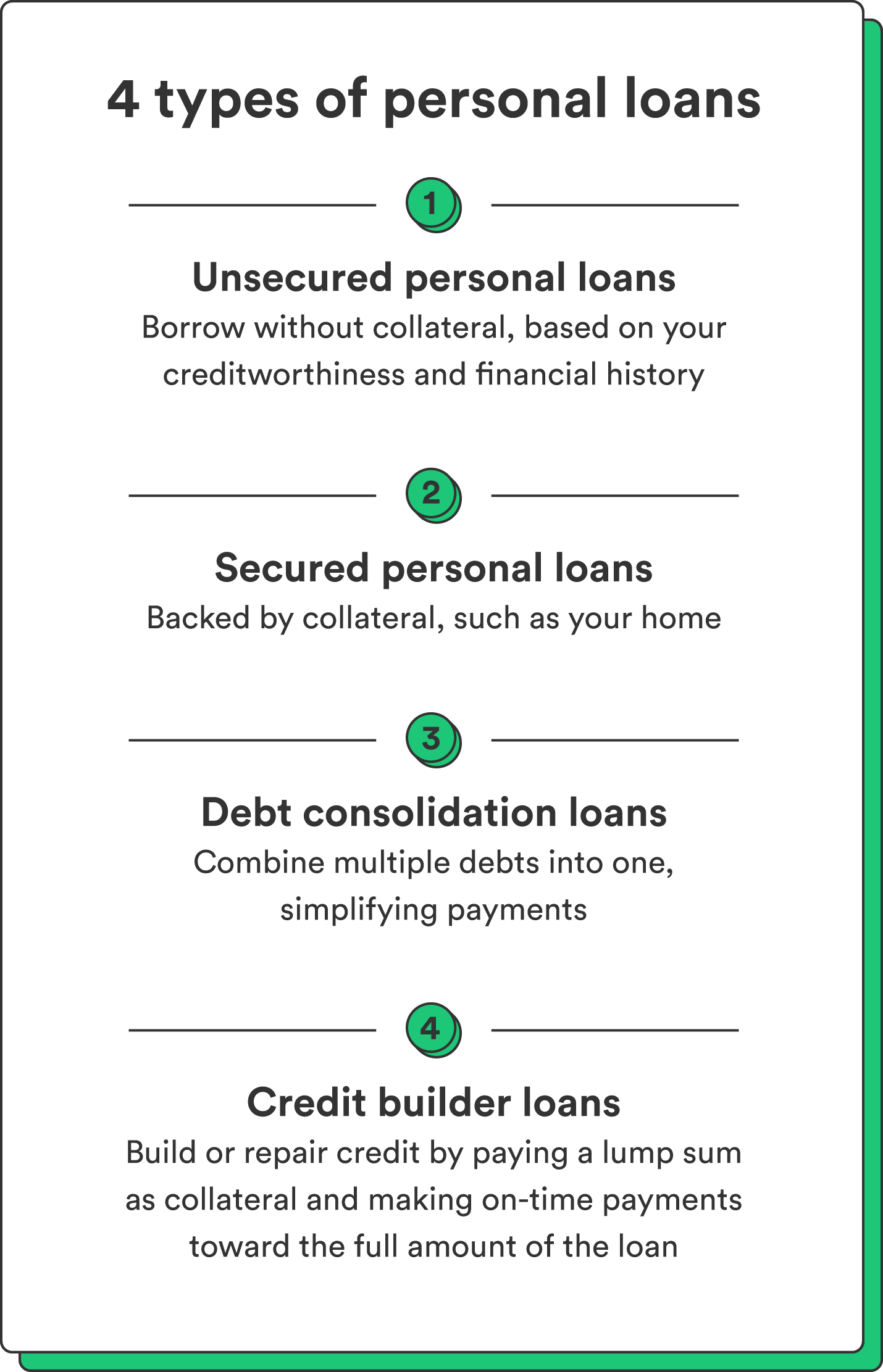

Some lenders may additionally bill fees for personal fundings. Individual loans are fundings that can cover a variety of individual expenditures. You can discover individual financings with financial institutions, credit history unions, and online lending institutions. Personal finances can be safeguarded, implying you require collateral to obtain cash, or unsafe, with no collateral required.

, there's usually a fixed end day by which the funding will be paid off. An individual line of credit history, on the various other hand, might stay open and available to you indefinitely as long as your account continues to be in good standing with your loan provider.

The money gotten on the finance is not exhausted. If the loan provider forgives the loan, it is thought about a terminated financial debt, and that amount can be exhausted. Read Full Report A secured individual financing needs some kind of security as a problem of website link borrowing.

The Personal Loans Canada PDFs

An unsecured individual car loan needs no collateral to borrow money. Banks, credit rating unions, and online lenders can use both protected and unprotected individual lendings to qualified borrowers.

Again, this can be a bank, debt union, or on the internet individual finance lending institution. If accepted, you'll be provided the car loan terms, which you can approve or turn down.

Report this page